The State Business Tax Climate Index Is Your Guide to Economic “Wins Above Replacement”

23 Oct 2020

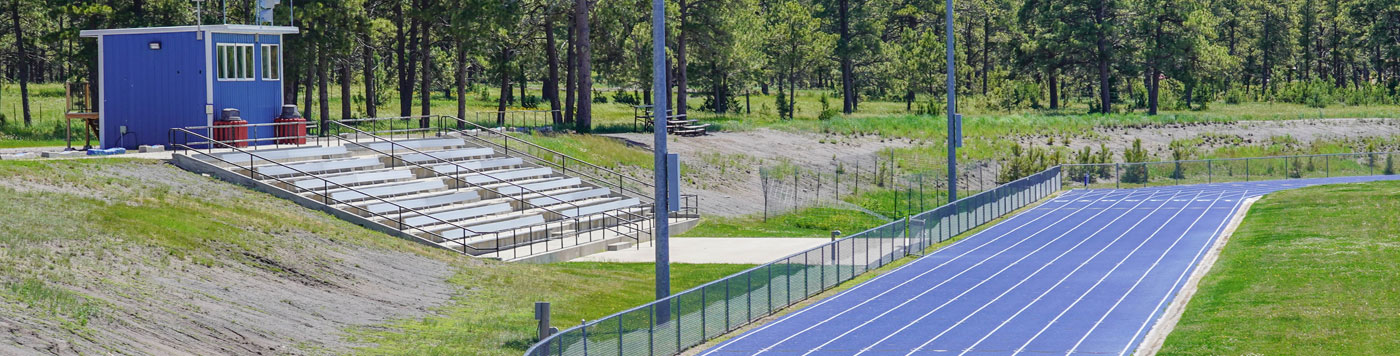

Earlier this week we published our annual State Business Tax Climate Index, which measures tax structure. It’s an extremely valuable diagnostic tool, enabling readers to compare states’ tax structures across more than 120 variables. Unlike most studies of state taxes, it is focused on the how more than the how much, in recognition of the fact that there are better and worse ways to raise revenue. Inevitably, though, the publication of the Index raises some questions, like: if Wyoming and South Dakota lead in the rankings, why aren’t more companies heading for the Black Hills?

Tax competition is a little like WAR—not conflict, but Wins Above Replacement. The term comes from baseball, where it is intended as a sabermetric statistic to measure how many more wins a team can claim due to a specific player above the amount that would be generated by a replacement-level player. It’s much the same way in public finance: a well-structured tax code won’t make the Wyoming Basin a metropolis, nor will poor tax structure make Manhattan a ghost town. But tax structure does play a role in a state’s economic successes or failures, and often a substantial one. Every state can benefit from a simple, neutral, transparent, pro-growth tax structure.

Continue reading here.

More Topics